Porinju Veliyath 20th July 2022

“The Current Thing” – soaring Inflation, volatile currency, geo-political disruptions….

Investing is laying out cash today to get more cash in future. “How much” cash we get in future and “when we get” that cash are essential questions investors ponder.

“How much” is a function of “Cash flows earned by businesses in the future” and “Price we pay”. Whereas “when we get” is essentially dependent on vagaries of markets governed by “crowd behaviour” – which no one has been able to predict nor will, in our view. Hence Investors’ key areas of day-to-day efforts should be directed essentially on “earning power of the businesses” and “what should one be willing to pay for them”.

Crowd behaviour is all about “the current thing” or “traded narratives”, and it is “recency bias” that forms the basis of one’s inference. If “inflation is high” and is reported by mainstream media in graphic details - in eyes of crowd, it would seem it is bound to last forever. “War”, “Pandemic” would appear they are never going to end when they are underway. However, in the universe generally most things are “Cyclical”. Sound investing is all about managing emotions and feelings from such collective mood swings well.

Some of our investors often have questions around “When we get”. The only rational and truthful answer to that is – if we have done a good job on assessing fundamentals and value, the price will follow eventually and no human on the planet has any insights about when. Equities is all about having patience around the right convictions.

And Value investors make right convictions around micro factors of companies and management and stay away from predicting or over analysing macro factors like interest rate, inflation, currency etc. This is not to say that they are not important. It is to say that we can do little about them in terms of investment decisions. They may very well lead us to buy high and sell low! A complete opposite of what we aspire to do.

Several Macro observers are comparing current economic phase to what happened in 70-80s in US. We let legendary investor Peter Lynch who navigated that market with success speak:

“1982 was a very scary period for this country. We’ve had nine recessions since World War II. This was the worst. 14 percent inflation. We had a 20 percent prime rate, 15 percent long governments. It was ugly. And the economy was really much in a free-fall and people were really worried, “Is this it? Has the American economy had it? Are we going to be able to control inflation?” I mean there was a lot of very uncertain times. You had to say to yourself, “I believe it in. I believe in stocks. I believe in companies. I believe they can control this. And this is an anomaly. Double-digit inflation is rare thing. Doesn’t happen very often. And, in fact, one of my shareholders wrote me and said, “Do you realize that over half the companies in your portfolio are losing money right now?” I looked up, he was right, or she was right. But I was ready. I mean I said, “These companies are going to do well once the economy comes back. We’ve got out of every other recession. I don’t see why we won’t come out of this one.” And it came out and once we came back, the market went north.” – Peter Lynch

Sensible Investing is all about focusing your energy on what is “important, knowable and controllable”.

“Tour de France” & Our Performance!

Legendary investor Terry Smith has a very interesting analogy with “Tour de France”. In Tour de France no cyclist has won every stage and sometimes overall race is won by someone who didn’t win any of the individual stages. Investing is a never-ending game and hence a long game. Various in between periods can confuse and take you off the race.

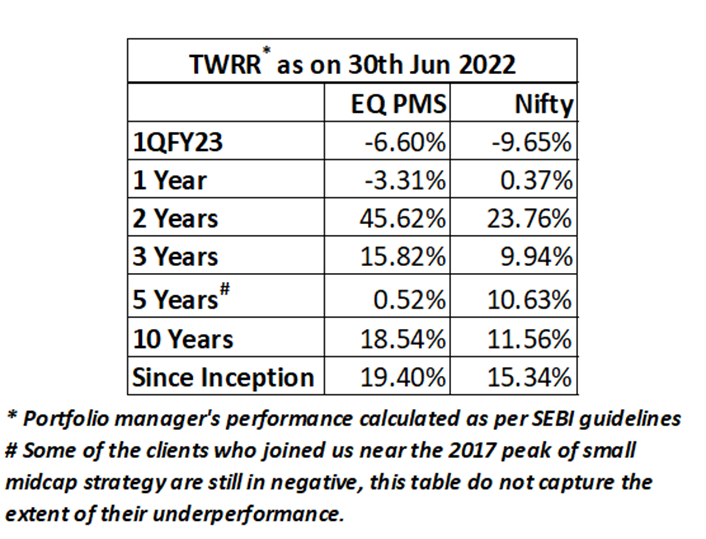

Do look at our own performance since inception versus broad markets. We are winning the overall race since inception or looking at 10 years period (which to our mind is critical as it covers one full business cycle). However, in 5 year-round we seem to have toppled off the bicycle – so it appears. But see subsequent rounds and we are paddling well again. At every stage of the race, we learn from past mistakes, double down on what is working for us and keep evolving in our craft. We think we have learned important lessons from 2018-19 period. EQ has laid foundations for an even better future based on those learnings.

Our current set of holdings continues to exhibit strong or improving fundamentals and possess satisfactory margin of safety in our assessment.

Eye on the business operator and not the stock flipper on the exchange

Benjamin Graham the father of value investing encouraged that buying shares should be viewed as buying piece of a business and not a piece of paper or ticker to be traded away. This implies one needs to see oneself as partner with business operators. This also requires us to listen to them carefully. Here are few words from business operators with whom we have partnered and what we make of them:

Our companies can manage inflation pressure well and continue innovating for future…

“We had undertaken price hikes in calibrated manner during the year and the quarter to counter the impact of higher input costs. However, we believe we will be able to see the benefits of this strategy over the coming quarters. We will continue to focus on introducing innovative led products in the market to ensure we cater to the increasing needs of our consumers.” – Rakesh Kaul, CEO and Whole-Time Director – Hindware Home Innovation Ltd. (Latest Concall)

Our companies are getting financially fit to grow and scale with endurance - enroute to compound long and far

“FY 2021-22 has a been a landmark year for Tata Communications! From witnessing green shoots of demand recovery, we progressed well in achieving our strategic shifts from products to platforms, gaining market leadership in our chosen business segments, our financial fitness with healthy improvement in free cash flow and, reduction in net debt, providing headroom to invest for future growth. While we have laid a strong foundation, we still have a lot to do. We are now investing in the right areas and are solely focusing on our growth target. …We are accelerating digital transformation journeys for enterprises with trust. We are all set to fire up our growth trajectory globally and be scalable, sustainable, and secure!” - A. S. Lakshminarayanan, Managing Director - Tata Communications Ltd (AR FY22)

India Story is not only about the so-called Start-up Unicorns. It is also about dramatic transformation of old established legacy companies…

I believe that the contours of the world are altering with power centre making a gradual shift towards Asia. The upheaval caused by the pandemic has been baffling for many nations. However, India continues to allure with a promising talent pool, strong domestic economy, resilient supply chains and the spirit of Atmanirbharta while spreading its wings to achieve the global dream of being an ideal manufacturing destination. At Raymond, we achieved the preferred supplier status for many more of our global clients and it’s a testimony to the India story that holds the beacon for a brighter future. As we approach our centenary year in 2025, the upcoming years will be defining a century-long journey of Raymond that will be a momentous milestone and a telling tale of how a homegrown brand reinforces its relevance in all Indian hearts. - Gautam Hari Singhania, Chairman and Managing Director, Raymond Ltd. (AR FY22)

For companies which do right things in terms of capacity building and resource allocation, fruits could be delayed but not derailed…

“Although the future is full of uncertainty and challenges, the outlook is one of cautious optimism. Recovery might get ‘delayed’ but not ‘derailed’. …We have built new capacities and capabilities, including R&D, Manufacturing and Quality and expanded our product portfolio to deliver long-term, sustainable growth in our generics business. We are hopeful that we will continue to deliver value and strengthen our foundation for growth. With formulations constituting the core of the Company’s business, Unichem is backward integrated to API manufacturing, which will add value to the customer in terms of quality and sustainability going forward. The outlook for the Company remains bright, going by the number of products/filings filed or lined up in coming years.” - Dr. Prakash A. Mody, Chairman & Managing Director - Unichem Ltd (AR FY22)

Some established companies are as agile and ready to grow as some of the start-ups…

“As we look to the future, it is clear that businesses are attempting to unlock their true potential by digitally transforming themselves. Technology projects that would otherwise have taken several years to roll out have been accelerated over a few months. Governments have an increased thrust on technology adoption to improve access to citizen services digitally, especially in the geographies we operate in.…On the back of an extremely successful past, we are just getting started!” - Rajiv Srivastava, Managing Director – Redington Ltd. (AR FY22)

Bring stable capital, attract right talent & incentivise them right is the mantra to solve sticky challenges… Great founders never worry about past... they are forward looking. When Opportunities are huge… patience is a small price that one has to pay…

“The confidence of the Board remains high in the Kaya Brand, as such investments have been made in new senior leadership with the joining of Mr. Rajiv Suri (former MD & CEO of Shoppers Stop), to strengthen the management team and to create a strategy with execution plans to propel growth in the coming years. ….Now, we look to more exciting chapters with a reimagined Kaya charting a courageous journey of transforming the beauty and care continuum.” - Harsh Mariwala, Chairman Kaya Ltd. (AR FY22)

Life should be played based on probabilities and not on possibilities.

Today’s worries will be replaced by tomorrow’s worries. Worrying is recipe for miserable life, in general and for sure as an investor. Life should be played based on probabilities and not on possibilities. If one bases decision on possibility - one would not step out of the room. It is possible that something horrible will happen the moment you step out of the house. A rational and practical way to live is to base it on probability instead. Always ask what is the base rate for something to happen?

And base rate of equities doing well over long term is high. Base rate is extremely high to get good returns when we have following factors in our favour at play: global advantages in emerging technologies, young population, strong and stable leadership, clean corporate balance sheet, recovering investment cycle, conducive policy framework and the current reasonable valuations

We think it’s a good time to put more money in to markets, if you intend to play the long “Tour de France”!

Regards

Porinju Veliyath